How often should you pay your employees?

Content

Time & AttendanceIntegrated time and attendance tracking, PTO request and accrual management, scheduling and reporting. HR SolutionsHR support, handbook development, training, safety and compliance — all the daily tasks of people management. Solutions PayrollPayroll tax filing, automated and integrated processing, paperless reporting and more. This includes the cost of job advertisements and the time spent interviewing and vetting potential candidates.

- Support A set of tools developed to help organisations manage and pay their employees on time.

- A weekly pay schedule is the second-most-common pay schedule, with 34% of employers using it.

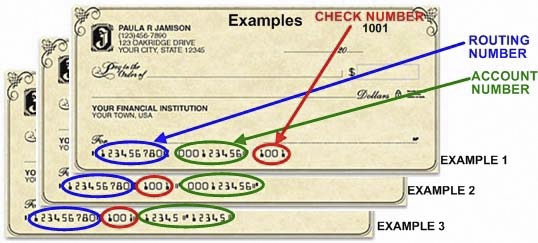

- The convenience of direct deposit benefits both employees and employers.

- If you are notpaying them consistently you may suddenly find yourself losing your best employees which are the driving force behind your success.

- Every business must decide which payroll schedule is the best for their company and employees.

- Hourly also offers time tracking and mobile payroll options—so you’ll spend seconds, not hours, processing your payroll each week.

Easier for employees to pay their bills, because they can plan/budget based on when they will be paid. It’s still easy to calculate overtime with an 80-hour pay period. Andrew Martins has written more than 300 articles for business.com and Business News Daily focused on the tools and services that small businesses and entrepreneurs need to succeed. Andrew writes about office hardware such as digital copiers, multifunctional printers and wide format printers, as well as critical technology services like live chat and online fax. Andrew has a long history in publishing, having been named a four-time New Jersey Press Award winner. Paying your employees on a regular schedule provides stability to your workforce. Your employees deserve to be paid on time for a variety of reasons.

The Value of Time

As a result, they are more focused on their work, which leads to increased productivity and quality. It’s a simple way to show your employees that you value their contributions to the workplace and want them to stay with your company.

What is the disadvantage of weekly pay?

Weekly Payroll Disadvantages:

Due to a weekly payroll system, the employer either has to get into doing the payrolls each time or assign a dedicated person for the same. This means, every time the payroll is made which is every week, the costs get higher for the employer to assign somebody to get the payrolls done.

Employees prefer being paid on time as it signifies respect in terms agreed. Support A set of tools developed to help organisations manage and pay their employees on time. Resources Why You Should Pay Your Employees Every Week A set of tools developed to help organisations manage and pay their employees on time. A set of tools developed to help organisations manage and pay their employees on time.

How often should I pay my employees?

Biweekly pay schedules encourage spending at a higher rate because it is easier for people on this type of schedule to have access to their money on more frequent occasions. It can also be difficult for people with kids if they are paid biweekly because it requires weekly child care costs that could be too expensive for many families expecting every other paycheck.

Pay frequency requirements by state determine what pay frequencies you can and can’t use. For example, Arizona requires that employers pay employees two or more days per month, not more than 16 days apart. Paying employees once every week for 52 weeks is common for hourly wage earners such as restaurant employees, shift workers, laborers, and skilled tradespeople. https://online-accounting.net/ With this approach, the advantage to your employees is that they’ll get paid more often. Additionally, funding payroll will be easier for your business since you’ll only need to cover one week’s worth of time. But from an administrative perspective, it could be more work for you because you’ll need to run accurate and on-time payroll every week.

Business Management

Contact us today to learn more about how we can benefit your business. No matter what type of payroll schedule your business opts for, Canal HR is here to help. Hundreds of businesses already trust us with their payroll duties and we’d be honored to earn your business and trust as well. Establishing a payroll policy outlining how employees are compensated during time off is essential to remaining compliant, as well as maintaining a transparent relationship with your employees.

- To help you understand which pay period frequency is the right fit for your business, we’ll go through the ten things you need to know.

- For example, if you’re still using outdated methods like checks or cash to pay employees, then upping your pay frequency means spending more money on printing supplies and more time on bookkeeping.

- Compared to paying employees on a weekly basis, both options may be simpler and less expensive for the firm.

- You should always have a business plan in place to ensure that your employees are paid on time, every time.

- There’s no right answer since every business is different — but you should make an informed decision.

The schedule should also include a description of what happens when paydays fall on a Saturday or business holiday if it isn’t made clear by the schedule. Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods. To further complicate matters, every decade or so the extra day from leap years wreaks bi-weekly pay havoc by necessitating a 27th paycheck.

Are there state law requirements for pay frequency?

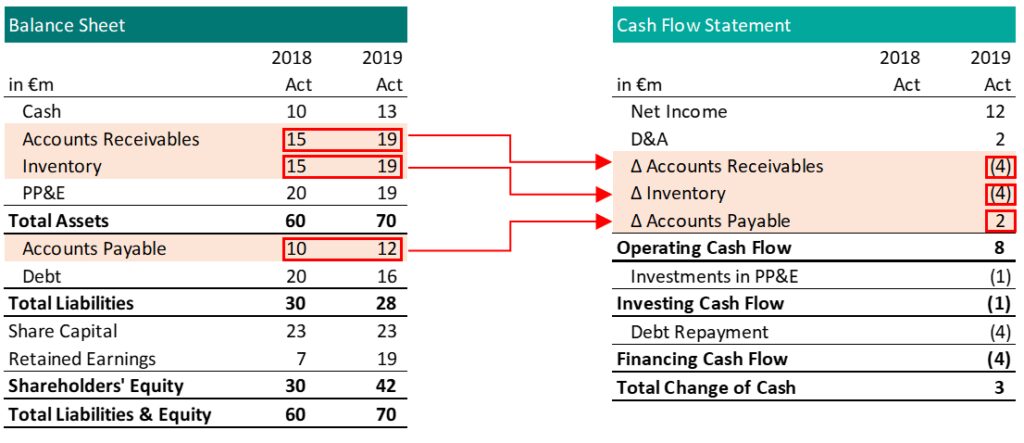

Bi weekly pay can make monthly deductions more challenging to calculate, though, because some months have more paydays than others. The employee is responsible for figuring up and processing these deductions on their own; for ease of use, there may be an option to adjust deductions across 24 paydays. This depends on the company, the payroll software, and the person.

Talent Over Budget: Hiring Strategies For The Modern Leader – Forbes

Talent Over Budget: Hiring Strategies For The Modern Leader.

Posted: Tue, 31 Jan 2023 12:30:00 GMT [source]

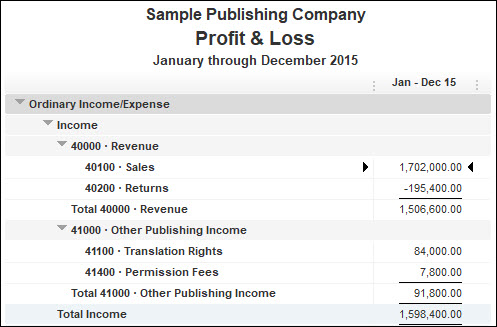

Yet, there are additional factors to consider when determining how often you pay your employees. Legal requirements, for example, must be met; then there’s your industry to consider; and finally, employee classification and payroll administration costs. Most businesses pay their employees biweekly, but another payroll… Sometimes, how and when you pay your employees can be considered a perk. By understanding how your industry functions and how employees in that industry like to be paid, you can tailor your pay schedule to fit those preferences, said Sean Manning, CEO of Payroll Vault. A pay period is the recurring amount of time during which an employee’s wages are calculated for payment; this period could span a week, two weeks or some other length of time.

…